Unlocking Credit

Accelerating Growth

A gateway for global investors to access one of the world’s fastest-growing credit markets.

What We Do

Credx operates a fully integrated private credit platform that connects global capital with high-quality, Shariah-compliant credit opportunities across Saudi Arabia. We finance the real economy through disciplined underwriting, institutional governance, and product innovation; enabling businesses to grow while delivering stable and consistent returns to investors.

Our Core Services

Institutional Private Credit in Saudi Arabia

Access diversified, Shariah-compliant private credit opportunities backed by real-economy assets. Saudi Arabia is one of the fastest-growing private credit markets globally, driven by Vision 2030 investment demand, SME expansion, and regulatory modernization. Credx provides institutional investors with a disciplined, transparent gateway into this emerging asset class.

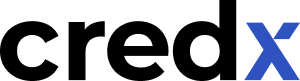

Direct Financing Investment Funds (DFIFs)

Exposure to high-quality SME and mid-market credit assets

Sukuk Income Funds

Diversified Shariah-compliant sukuk across primary & secondary markets.

Multi-Strategy Private Credit Funds

Trade finance, SCF, term finance, and structured credit portfolios.

Shariah-Compliant Securitized Instrument

Structured exposure to diversified receivables and real-economy assets.

Flexible, Shariah-Compliant Financing for Growth

Credx provides fast, asset-backed financing designed for the real operating needs of Saudi SMEs and corporates. We help businesses unlock liquidity, stabilize working capital, and scale operations, without dilution or long bank processes.

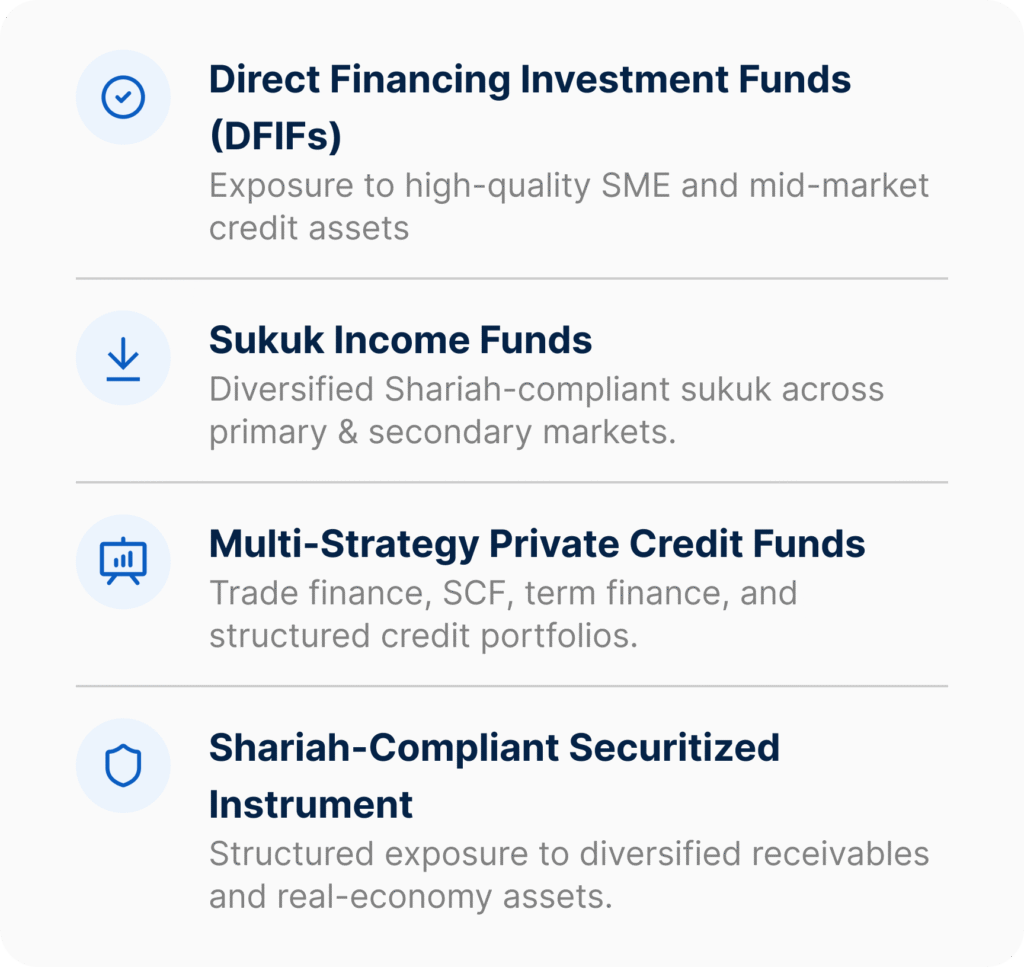

Financing Solutions

- Receivables Financing

- Payables Financing

- Trade & Supply Chain Finance

- Inventory Finance

- Short-Term Corporate Finance

- Contract-Backed & Asset-Backed Facilities

Why Corporates Work With CredX

- Faster approval and onboarding through tech-enabled underwriting.

- Customized structures aligned with procurement, sales, and seasonal cycles.

- Funding that fuels growth without equity dilution.

Partnerships That Power the New Private Credit Ecosystem

Credx partners with institutions that want to originate, distribute, or embed private credit solutions into their offerings. We enable partners to scale through capital, technology, structuring expertise, and Shariah-compliant program design.

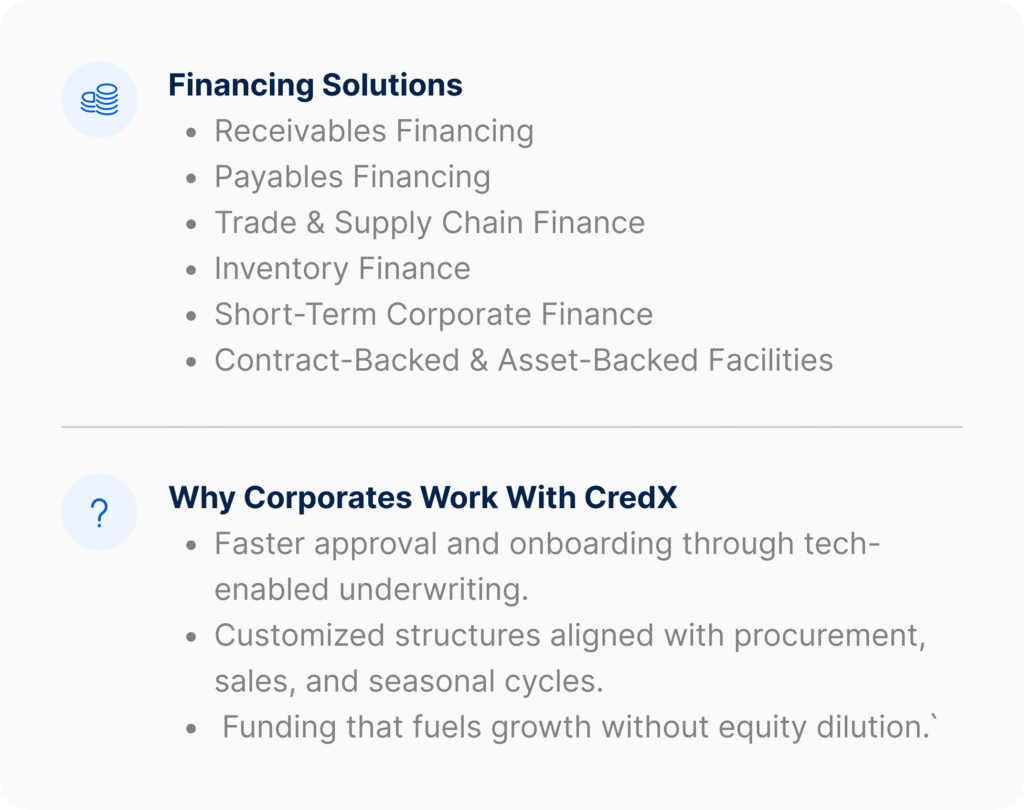

Financial Institutions

Banks, investment firms, and non-bank lenders seeking to expand credit distribution, co-lend, or launch structured financing programs.

Fintech & Digital Platforms

Digital lenders, embedded finance platforms, and marketplace ecosystems that require funding capacity and credit infrastructure.

Corporate Anchors & Large Enterprises

Industry leaders aiming to support their supply chains through reverse factoring, supplier finance, or embedded working-capital programs.

Technology & ERP Providers

Systems that enable automated data connectivity for underwriting, invoicing, and real-time credit monitoring.

Insurance & Advisory Networks

Insurance brokers, corporate advisors, and intermediaries that facilitate access to business clients and specialized financing needs.

Merchant & Payment Ecosystems

Payment processors, merchant acquirers, and commerce platforms serving SMEs and distributor

Our Core Services

For Investors

Institutional Private Credit in Saudi Arabia

Access diversified, Shariah-compliant private credit opportunities backed by real-economy assets.

For Corporates

Flexible, Shariah-Compliant Financing for Growth

Credx provides fast, asset-backed financing designed for the real operating needs of Saudi SMEs and corporates.

For Partners

Partnerships That Power the New Private Credit Ecosystem

Credx partners with institutions that want to originate, distribute, or embed private credit solutions into their offerings.

Market Insights

Financing the Next Chapter of Saudi Growth

Private credit as a cornerstone of Vision 2030, SME expansion, and capital market development.

Case Studies

Our Partners

We collaborate with leading institutions and organizations that share our vision for sustainable financial growth.

Have a question or looking for the right solution?

Connect with us and we’ll guide you toward the best next step.

Office Location

-

SP02, Al-Faisaliah Tower,

King Fahd Road, Al Olaya,

Riyadh, KSA 3019

Contact

- info@credx.com